John Murphy Business's Cycle

- Stage 1 shows the economy contracting and bonds turning up as interest rates decline. Economic weakness favors loose monetary policy and the lowering of interest rates, which is bullish for bonds.

- Stage 2 marks a bottom in the economy and the stock market. Even though economic conditions have stopped deteriorating, the economy is still not at an expansion stage or actually growing. However, stocks anticipate an expansion phase by bottoming before the contraction period ends.

- Stage 3 shows a vast improvement in economic conditions as the business cycle prepares to move into an expansion phase. Stocks have been rising and commodities now anticipate an expansion phase by turning up.

- Stage 4 marks a period of full expansion. Both stocks and commodities are rising, but bonds turn lower because the expansion increases inflationary pressures. Interest rates start moving higher to combat inflationary pressures.

- Stage 5 marks a peak in economic growth and the stock market. Even though the expansion continues, the economy grows at a slower pace because rising interest rates and rising commodity prices take their toll. Stocks anticipate a contraction phase by peaking before the expansion actually ends. Commodities remain strong and peak after stocks.

- Stage 6 marks a deterioration in the economy as the business cycle prepares to move from an expansion phase to a contraction phase. Stocks have already been moving lower and commodities now turn lower in anticipation of decreased demand from the deteriorating economy.

Cara yang paling mudah untuk melihat harga emas. BUY LOW SELL HIGH.

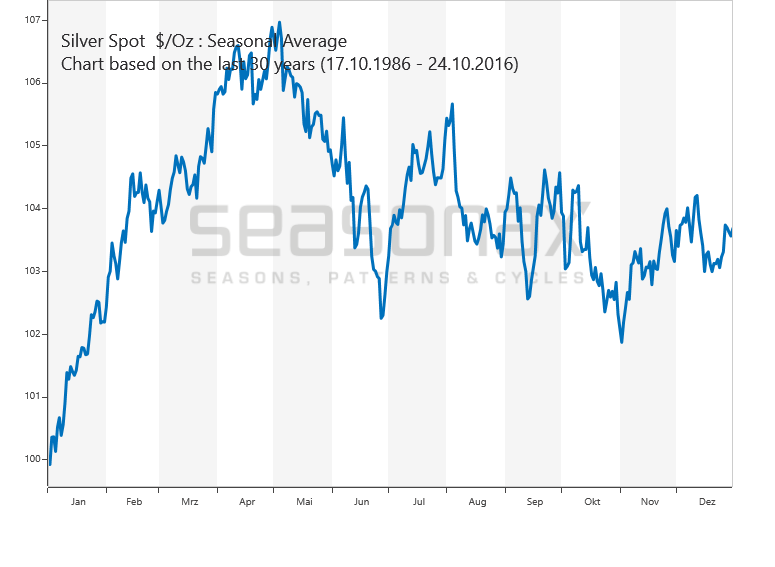

Graf tambahan kepada yang berminat dengan silver.

No comments:

Post a Comment